Dr Leslie P Willcocks

Challenges for utilities

This month I am reporting on joint work done with my colleague John Hindle of Knowledge Capital Partners. Previous papers in this series of blogs have looked at intelligent automation in healthcare, banking, insurance and telecommunications. We found distinctive challenges and ways forward in each. So what about utilities, usually seen as one of the more stable sectors in developed economies?

In fact few industries have been as buffeted by change over the past 25 years as energy and water utilities. Industry restructuring, globalisation, deregulation, and digital technologies have combined to upend what was historically a comfortable, almost leisurely, operating model: a regulated monopoly, based on vertically integrated supply, predictable demand, long service lifecycles, and highly commoditised products. The scale of public utility operations, however—once a formidable asset and barrier to entry—would become a potentially massive liability in a disaggregated value chain, as more agile intermediaries emerged—resellers, digital-first utilities, and alternative sources of supply. Their very lack of large-scale legacy systems would give the challengers a huge agility advantage. Steering battleships and all that …!

When customers in any sector are offered choice, research shows that the service experience aross the customer lifecycle—pricing, speed, responsiveness and reliability—becomes the major determinant in customer retention and acquisition. And the ability of challengers to sense and respond to these drivers becomes a critical competitive advantage. However, incumbent utility providers’ massive operating scale—an impediment to such agility—could also create a perfect laboratory for innovation. Dominant utilities could leverage their deep knowledge about their customers—service histories, trouble reports, consumption and pricing patterns, payment preferences, etc—to offer innovative service configurations and more competitive pricing

The business challenge is the same for incumbents and challengers alike: how to offer reliable, personalised service at scale with constant customer-perceived improvements and keen pricing. The strategy adopted by incumbents we’ve researched is twofold: mass customisation—applying digital technologies like RPA and cognitive tools to match their challengers’ service innovation strategies—while simultaneously and continuously controlling the cost base and meeting regulatory compliance. For incumbents and challengers alike, however, the solution begins first and foremost with the customer experience.

Better service through automation

Three management practices are central to automation adoption in utilities: mass customisation, service quality (SERVQUAL) and customer life-cycle management. Mass customisation applies mass production techniques to what is invisible to the customer, e.g., a car engine, and customisation to what is visible, e.g., seat upholstery. Because utilities have very commoditised products (energy and water), it is in the customer-facing service dimension—where incumbents now hurt most and competition is most intense—that mass customisation can be applied most productively.

It is an oft-quoted truism that the customer’s perception is the provider’s reality. Nowhere is this phenomenon more acute than the potential gap between the customer’s service expectations and the actual experience. SERVQUAL is a multidimensional research instrument and gap model across five dimensions of service quality.

1. Reliability—the ability to perform the service dependably and accurately—is the key service dimension. Four other dimensions are influential, however:

2. Assurance—the knowledge and courtesy of staff, and the confidence and trust they generate.

3. Empathy—the provision of caring, individualised attention.

4. Responsiveness—the willingness to help the customer and provide prompt service.

5. Tangibles—location, appearance of staff, call centers, equipment, etc.

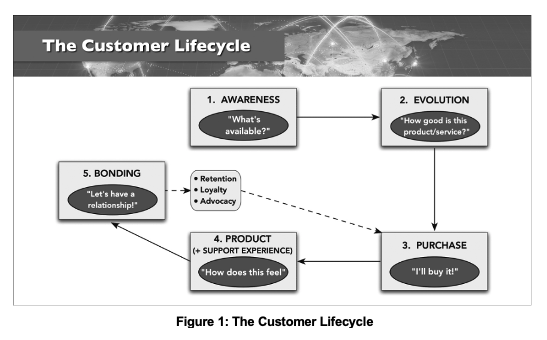

Today utilities have to focus on all these dimensions—at every touch point of a customer’s experience—to compete effectively. As Figure 1 shows, these are surprisingly many. What is impressive is how intelligent automation (RPA plus cognitive tools—machine learning, algorithms, visual and natural language processing, etc.) can leverage each of these touch points through high service, while generating analytics to improve and anticipate future service. This approach enables granular personalisation for mass customer bases. What is surprising is how few utilities have yet grasped the full potential of these opportunities with automation. Let’s look at three utilities that have.

Three examples

United Kingdom

In 2008, a provider of electric power to residential and business customers became one of the earliest adopters of process automation, conducting several proof-of-concept implementations to become familiar with the capabilities and potential of the technology. Following a typical pattern confirmed in our research, the provider’s initial focus was on Efficiency– reducing the utility’s operating costs by applying technology rather than hiring additional staff to handle steadily increasing process transaction loads. At its peak, the utility’s digital workers were handling 500 separate processes involving 18 million work items, doubling the company’s initial forecasted productivity gains as automation grew.

Mirroring the journey our research discovered, this initial Efficiency focus led on to more significant gains in Effectiveness. By optimising its workforce and applying human workers to more complex customer-facing tasks, the utility greatly improved customer satisfaction and regulatory compliance in traceability and auditability. Additional Effectiveness gains came from using digital workers to manage process workflows, automatically assigning workloads to available Digital Workers and generating completion reports. By analysing the process data captured from its Efficiency gains, moreover, the company re-configured end-to-end cross-functional processes, capturing significant employee satisfaction gains. The company reports that its overall Effectiveness gains were five times its expected results.

The company’s automation platform also delivered critical Enablement gains. For example, the COVID–19 pandemic emergency required staff to operate from home, on their own personal technology—a potential nightmare for a highly regulated industry dealing with sensitive customer data in hundreds of insecure domestic technology environments. Using its intelligent automation platform, the company—in just two weeks—built and deployed a new process enabling staff to access servers remotely using RSA security system tokens. The virtual work solution enabled thousands of staff to respond quickly and support customers during multiple extended lockdowns. The intelligent automation platform also enabled the company to extend emergency credits proactively to pre-pay key and card customers who couldn’t access brick-and-mortar stores during lockdowns. This Enablement innovation created a uniquely powerful customer experience and widespread goodwill.

Overall the organisation planned for some 40 percent gains from Enablement, but is actually getting 50 percent, from areas like increased resilience, improved new business development, richer customer and employee experiences, better integration across channels and partners, and some first mover advantages against the competition. The intelligent automation platform has facilitated increasing business and operational innovation.

Global

Restructuring and consolidation of the global energy industry are creating multiple demands for intelligent automation solutions. When a major energy conglomerate decided to split its power generation and energy trading operations from its retail service operations, it established a new listed company in 2016. With operations in over 40 countries, supported by 13,000 employees, the new company focuses entirely on power generation (derived from coal, hydro and gas production), and global energy trading.

The company used RPA to do Agile implementations across functional teams, optimising processes, increasing compliance, and improving reconciliations generated by large-scale energy trading activities. Integrating chatbots and artificial Intelligence tools with its RPA platform, the utility automated its end-to-end procure-to-pay process. Digital workers now create 120,000 purchase orders per year, generating new supply contracts and updating existing ones directly in the company’s SAP system. They confirm valid certifications from 4,000+ suppliers and send renewal requests where required, using an AI algorithm to recognise different certificate types. They prioritise, bundle and dispatch urgent purchase requisitions to the responsible groups, and book 50,000 goods receipts per year automatically.

While wholesale transactions are fewer than retail, the cost of an imbalanced portfolio is much more consequential given the scale of each transaction, and the seconds saved in entering values to websites can be millions of dollars. Digital workers now make checks every 5 minutes to ensure the energy portfolio is balanced across supply and demand, a metric critical to customers’ success. Customer satisfaction metrics have increased to 95 percent “fully satisfied”, while supplier relationship management improved due to faster payment response.

Digital technology was essential to superior operational performance in a competitive marketplace, to be sure, but management also realised that intelligent automation could be a platform to instill and sustain a strong performance culture for the new company, built on agility, responsiveness to market changes, and rapid decision-making. Employee satisfaction and employer branding became key benefits of the automation program, and in the company’s own words, “It is change management… not a ‘technology’ initiative… with a key focus on culture change, organisation transformation, and people enablement.” While the company had not quantified any culture gains in building its business case, the ability to unify and motivate the organisation around these values proved the most significant and valuable Enablement outcome from automation.

Europe

A multi-national retail energy provider with national distributors operating in multiple countries/markets has shared centralised support resources, including a digital technology function to lead on digital transformation, and a trio of centralised process automation resources to support its national customer-facing businesses:

• A Business Process Management team, working with operating units to identify and assess the best opportunities and use cases for automation

• An RPA team that builds, tests and deploys automations to deliver automated processes to business units on standardised platforms;

• An Intelligent Automation team, that identifies, assesses, and works with the RPA team to integrate task-appropriate cognitive and Machine Learning tools to deliver the required automations

Each of these resources maintains a library of proven objects and automations, along with experienced and knowledgeable specialists, to ensure quality and promote consistency across the wider enterprise and its operating units. The management objectives of this model are:

• to improve customer experience through efficient contact and complaint resolution

• to reduce use of third-party transactional outsourcing by bringing work back in-house

• to reduce regulatory exposure—e.g., for erroneous customer billings

• to reduce demand loads on staff by promoting self-service solutions

90 percent of the business units and national providers plug into a common intelligent automation platform, based on one RPA provider. Set up in this way the multinational has been getting 10 percent Efficiency gains across all its sub-units. The Effectiveness gains so far have been 22 percent, the top three being actionable insights from end-to-end analytics, regulatory compliance improvements, and much higher throughput and volumes without additional workers. The company is also seeing Effectiveness gains from being a more connected enterprise, IT functional optimisation and and gaining more return per employee while scoring higher employee satisfaction and richer total customer experiences.

On Enablement gains, the company planned for 10 percent, but is on course for 20 percent whole organisation improvements. The main gain has been in working the data, and creating knowledge that can be leveraged for business advantage. The lines of business are more configurable, operational changes can happen faster e.g., changes in pre-paid meters, responding fast to customer needs during COVID–19, and analytics brings customers closer, while making the company more anticipatory and responsive to changing customer requirements. As a big scaled organization, growth has been slow and organic but more options cointinue to emerge from their emerging digital platforms and infrastructure.

Conclusions

There are some learnings from our research into utilities

1. The best users of intelligent automation, like the ones discusssed here, are finding their own ways to building a digital infrastructure, an intelligent automation capability, and a digital platform for innovation. Along the way they are finding that the 3Es of our TVO model are mutually complementary. Greater Efficiency can lead to Effectiveness, which can lead to Enablement. With rising technology capability and delivered results comes bigger aspirations; then value increases exponentially at each stage.

2. We have seen that what you can do for the customer rises across the three phases. Looking at SERVQUAL, Efficiency can drive service reliability, accuracy and speed, some more tangibles for the customer. Effectiveness sees more empathy, and assurance. But at the Enablement, the organisation is technically capable of making all these experiences so much richer, and can also deliver these experiences, through intelligent automation, at every stage of the customer life-cycle (Figure 1). This becomes the source of customer differentiation in utilities.

3. The ways in which these organisations collect, analyse, utilise and convert the data into real-time knowledge for strategic and operational purposes gives them the inside track in competing in the utilities sector. Data may be the fuel, but it is the knowledge engine, enabled by the intelligent automation and digital platforms, that makes for sustained competitive advantage.

4. In the course of this research we came across ‘upstart’ utilities in the energy sector, with strategic bets on these propositions inherent in their strategic DNA and whole mode of operation. Mass customisation, and increased customer intimacy managed across the customer life-cycle has been augmented irreversibly by the coming of intelligent automation and related technologies. Which way are you going to make your strategic bet?