Dr Leslie P Willcocks

We all have a Blind Spot. Part of the optic disc lacks some cells to detect light, and to that extent our vision is impaired. Fortunately, based on surrounding detail and information from the other eye, our brain interpolates the missing data, so it is not normally perceived. We have encountered a similar process amongst corporations seeking to become digital ...Introduction

Much can be made of executive and organisational ‘blind spots’. For example, in her 2007 book Blind Spots, Madeline Van Hecke devotes a chapter to each of ten mental blind spots that afflict even the smartest people:

- 1. not stopping to think

- 2. jumping to conclusions

- 3. my-side bias

- 4. getting trapped by assumptions and categories

- 5. not paying attention to details

- 6. not understanding themselves

- 7. ignoring evidence

- 8. missing hidden causes

- 9. not seeing the big picture

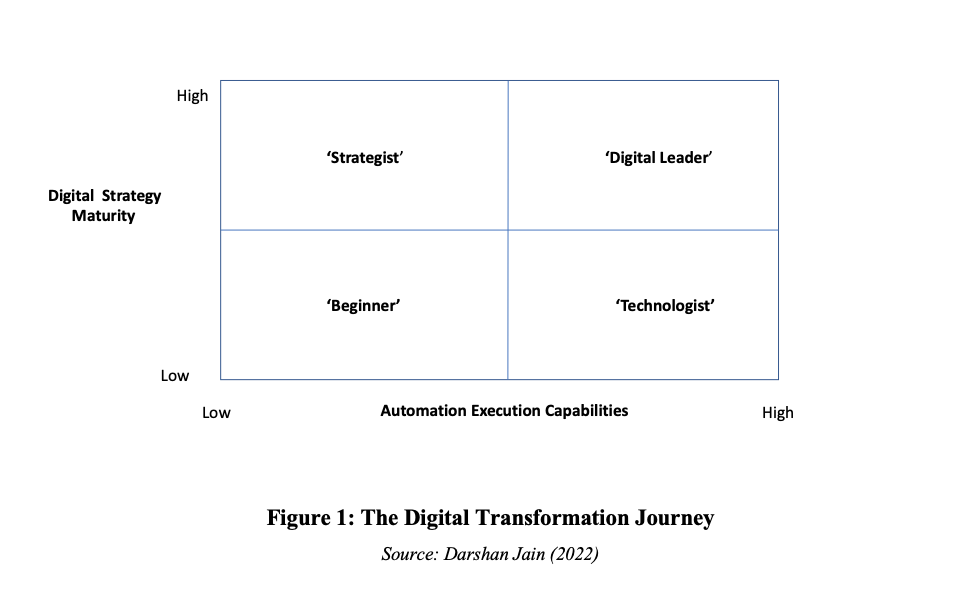

In research recently carried out with Dr. John Hindle of Knowledge Capital Partners, we discovered a blind spot in many digital transformations. The blind spot arises—especially in very large organisations—when those driving the digital transformation agenda (the ‘Strategists’ in Figure 1) have different agendas, resources, stakeholders and organisations than those responsible for achieving the automation of knowledge work.

Typically, ‘Strategists’ are doing a lot of right things. Especially, they develop good digital strategy and planning processes, and their digital platform is benefitting from a lot of care and attention, but their execution of strategy is weakened through a variable mix of governance, navigation, culture and change management factors. Most typically, ‘Strategists’ are driving their DT agenda from a higher position in the organisation than the automation ‘Technologist’ stakeholders, who are focused on scaling automation infrastructure to create an imbedded enterprise capability, typically governed by an automation Centre of Excellence (COE).

All parties may feel success, but in practice the organisation has created new silos for old. The result: disconnects—both technological, and organisational. Technologically there can be at least ten major technologies in play for true digital transformation: social media, mobile, analytics, cloud, blockchain, robotics, automation, internet of things, digital fabrication and augmented reality. Intelligent automation makes inroads into converging only a few of these—typically analytics, cloud, automation, and to some extent internet of things. Organisationally, the processes and staffing for the DT and automation agendas are separate, and do not converge, resulting in a ‘ships passing in the night’ outcome. ‘Strategists’ view automation as a tactical tool; ‘Technologists’ see digital transformation as little to do with them.

The Secret of Success: Integration

Happily, we have seen a few organisations break through this impasse. Two illustrative examples. In 2015, one North American bank adopted a new value-oriented, purpose-driven management philosophy of increasing organisational agility and improving customer experiences. A key focus involved transforming disjointed operating processes on an end-to-end basis, but from the customer’s perspective. The automation business case was based on increasing the value of the bank’s services as measured by customer metrics—retention rates, service expansion, and improved net promoter scores —rather than simply ‘doing (bad) things faster’. In addition to Efficiency savings estimated at more than 200 percent from the ability to access and use previously trapped data, the bank also estimated a 400 percent gain in enterprise Effectiveness—measured by increased customer retention and revenues from broader services integration. The bank’s Intelligent Automation platform has also supported greater Enablement gains in terms of new products and services, enterprise resilience, first-mover advantage, public goodwill and reputational equity. The bank estimates the resulting gains in enterprise Enablement to be greater even than the combined Efficiency and Effectiveness gains.

So, the prize is huge. But it is also difficult to grasp. About 65% of digital transformations are unsuccessful, abandoned or seriously disappointing. On average even successful transformations realise only 67% of the potential value. There are blocks and pipeline leaks everywhere. Up to a quarter of this lost value occurs in the planning and start-up stages—e.g low targets, poor planning processes, bureaucratic governance. Some two-thirds occurs during and after implementation.

Similarly, a major Middle East bank undertook an enterprise-wide transformation to seize a leadership position in its key markets, using Blue Prism technology as a strategic platform. By combining Intelligent Automation with Natural Language Processing (NLP), machine learning (ML), and data mining tools, the bank developed a totally automated end-to-end solution to track payment status, pull relevant payment and customer details, and apply rule-based validations, referrals and query responses, with no manual intervention. The solution delivered 100 percent improvement in quality, response times, and customer experience. The new process also generated Enablement gains from the resulting wealth of data and management information—raw material for applying data science using Hadoop to improve management decision-making. International transaction enquiry handling turnaround time also went from 8–12 hours to less than 2 minutes, resulting in a transformed customer experience.

The senior executives in these organisations adopted a strategic mind-set in deploying Intelligent Automation. With a transformative view and an enterprise vision suffusing from the top, the strategic uses of automation delivered greater Effectiveness and Enablement gains, beyond just Efficiency. These organisations also started with an external focus on customers and competition, using that perspective to design—from outward in—an end-to-end business process architecture that accelerates digital innovation. The banks’ experiences demonstrate that building a robust in-house automation capability creates flexibility and a knowledge base which, with strong governance and disciplined behaviours, form part of the Enablement platform that accelerates strategic uses of automation technologies.

Clearly these organisations are not just moving rapidly across the horizontal axis of Figure 1, but also up the vertical axis, putting themselves on the edge of being digital leaders. But they have a long way to go to match Singapore-based DBS bank, several times voted the world’s best bank, and an exemplar of digital leadership in our research1 , building, over time, all the required digital transformation capabilities, and deploying intelligent automation well integrated into their digital platforms.

Towards Digital Leadership

In the last year we have seen more ‘Digital Leaders’ emerge. Two examples. Using KCP/BP diagnostics, one bank rated their Automation Execution capability and Digital Strategy capabilities around 70 percent. In practice, all their capabilities needed strengthening, but the diagnostic provided a disaggregated analysis and pointed them precisely to where they need to focus and improve over the next year within each capability. Automation Execution Capability consists of five capabilities: pipeline, delivery, service model, technology and people. On Automation Execution maturity, the bank identified weaknesses in applications management and platform maintenance. More work needed to be done on service definition, design and delivery methodology, and also, in the people capability, specifically on training. We measure Digital Strategy maturity as progress on seven capabilities: strategy, integrated planning, governance, imbedded culture, digital platform, change management and navigation. On Digital Strategy maturity, the bank proved very strong on strategy and planning, weaker on governance, change management and especially navigation. The analysis enabled it to set itself ambitious improvement targets for 2022.

A second major bank has a digital workforce numbering many hundreds and had a score of over 70 percent on Automation Execution capability, but in the lower 60s percent for Digital Strategy maturity. This put them in the Digital Leadership box (Figure 1)—a pleasant surprise as they felt day-to-day more like firefighting technologists! That sense arose because they were indeed scoring themselves low on technology, and had a lot to do on technology infrastructure and applications management. Other weak points identified included ROI metrics, testing, business reporting and training. On Digital Strategy maturity they were making good progress—above the industry average—on strategy, planning and digital platform, but were scoring between 50-60 percent on culture, change management, governance and navigation. This galvanised them into ambitious targets over the next year to push them higher into the digital leadership box, aligning their Automation Execution and Digital Strategy capabilities (Figure 1). The diagnostic pointed them precisely to targeting particular skills sets within each capability.

Both banks were managing well the blind spot we identified earlier, and integrating Automation Execution with Digital Strategy capabilities. But both also recognise that they are hardly done and that Digital Transformation is a continuous and never-ending improvement process, if they are to outflank competitors on similar journeys.

The Progress Being Made

One of the myths perpetuated on the internet, even in articles and books published in 2022, is that ‘90 percent of CEOs believe the digital economy will impact their industry, but less than 15 percent are executing on a digital strategy’. We eventually found the source of this quote. It is from a 2012 MIT/Cap Gemini study2. The quote is, of course, out of date, concurrently incorrect, and its continuous use very misleading. MIT/Cap Gemini themselves have performed many more recent studies, as have McKinsey and MIT, and their work—as at 2022—is consistent with our own recent findings.

For example, Cap Gemini Research Institute has identified accelerated Digital Transformation progress over even the previous two years. In 2020, on average 60 percent of organisations (66 percent in banking) reported they had the digital capabilities, and 62 percent (66 percent in banking) the leadership capabilities required for digital transformation 3.

Looking across multiple studies, organisations generally, and digital leaders especially, have increased their investments in Digital Transformation since 2018, increased their adoption of emerging technologies for enhancing their digital platform, and given renewed focus on talent, culture, operations, customer experience, and business innovation. The COVID-19 pandemic has greatly accelerated this shift to digital. Even so, research studies are finding that over the last four years digital leaders have been widening even further the significant pre-existing gaps between them and their competitors on digital transformation, capabilities practices and performance.4

These findings are consistent with KCP findings already published.5 Our most recent research has been examining how organisations can make further progress whatever their competitive positioning. The key lies in building distinctive, identifiable capabilities and integrating them to create the synergies that produce significant business value. The evidence suggests that, by 2022, not doing so is no longer a competitive option.

Conclusion

Significantly, research shows that companies that have embraced the digital world and execute on their digital strategy register real gains in shareholder and stakeholder value. Even in 2013 digital leaders were typically above their industry average by 9 percent on revenues, 26 percent by profitability and 12 percent by market valuation. Meanwhile against their industry average, digital beginners were seeing up to 4 percent lower revenues, 24 percent lower profitability, and 7 percent lower market valuation. A 2018 McKinsey study, looking just at automation, predicted that leaders stood to register an annual cash flow growth rate of six percent, thus doubling their cash flow between 2018 and 2030. Meanwhile automation laggards stood to experience a 20 percent decline in cash levels over the same period.

Over the last four years the gap between digital leaders and all other organisations has been widening. As one example, a 2018 CGRI analysis found a 38 percent difference on testing digital ideas quickly, expanding to a 48 percent gap during 2020. Through 2020- 2022 KCP research was finding that many more organisations were moving faster on digital, in some cases driven by the need to survive in pandemic conditions. However, digital leaders were investing larger and faster than the industry average, and more strategically. Moreover, digital leaders were improving their own execution capabilities, gaining further ground rapidly on revenues, profitability, market valuation, and other leading indicators.

Digital leaders will, by instinct and practice, endeavour to stay ahead, but the widening gap between them and the rest is not inevitable. Time and again we find that in terms of achieving superior business performance the productive combination of 25 percent technology, and 75 percent management makes the real difference.

References

- 1 See Willcocks, L. (2021) Global Business: Management. (SB Publishing: Stratford) Chapter 9 ‘Moving to global digital business’. Also Knowledge Capital Partners Executive Briefings, August 2022.

- 2 MIT/CapGemini (2012) . The Digital Advantage: How digital leaders outperform their peers in every industry. Cap Gemini Consulting ebook.

- 3 Cap Gemini Research Institute (2020) Digital Mastery: How organisations have progressed in their digital transformation over the last two years. See www.capgemini.com/researchinstitute/

- 4 See Bonnet, D. and Westerman, G. (2021). The New Elements of Digital Transformation. MIT Sloan Management Review, Winter—Research Feature. Also CGRI (2020) op. cit., McKinsey Digital (2021) The New Digital Edge: Rethinking Strategy For the Postpandemic Era. May; also McKInsey Digital (2022). Prioritising Technology Transformations To Win. March. See https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/prioritizing-technology-transformations-to-win

- 5 Knowledge Capital Partners (2020). Covid-19 Business Recovery and Technology: Different This Time? www.knowledgeCapitalpartners.com/publications/